Blog

-

-

Manager of Climate Intelligence, Rocky Mountain Institute (RMI)

Jun 29, 2022

Here’s a sobering truth: To meet the Paris Agreement’s goal of limiting global warming to 1.5°C, the world needs to rapidly transition towards a low-carbon economy. But the question is: How is this going to be accomplished?

Here’s a sobering truth: To meet the Paris Agreement’s goal of limiting global warming to 1.5°C, the world needs to rapidly transition towards a low-carbon economy. But the question is: How is this going to be accomplished?

It will mean doubling down on everything from electric vehicles (EV) to renewable energy sources like wind and solar for energy transmission and storage. It will also mean ramping up production of the minerals required for these critical technologies, like nickel and copper. In fact, at least 17 minerals and metals will be needed at scales significantly beyond current production levels to drive the transition to net-zero emissions by 2050. And herein lies the challenge: There are significant GHG emissions associated with mining these critical minerals. To achieve net-zero, the mining sector must aggressively decarbonize to reduce the emissions intensity associated with exponential growth in demand for these critical minerals by 2050 or sooner.

This will be no small feat and collaboration will be key, as outlined in IFC’s Net Zero Transition Roadmap for Nickel and Copper, planned to launch this fall.

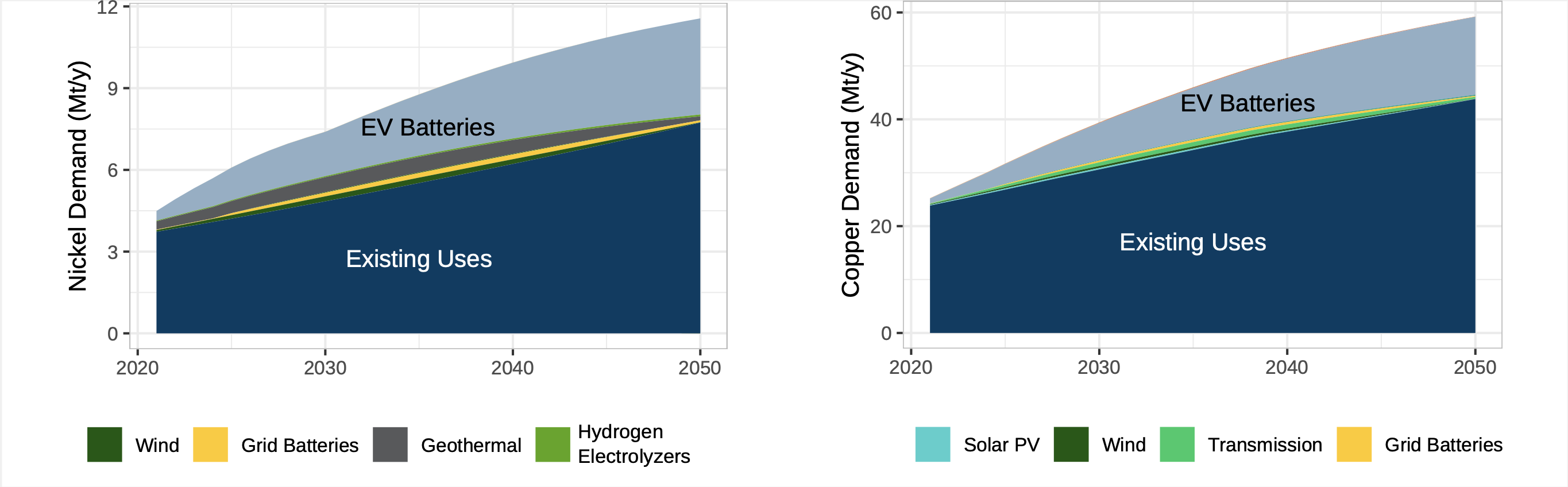

Projected demand growth to support the energy transition

Our models show that a large part of additional nickel and copper demand will come from EV batteries, which use nickel as a core component in the battery cathode and copper for electrical connections at the cell and pack level. These baseline models indicate that by 2050, annual nickel demand will need to increase by 102 percent and annual copper demand will grow 56 percent, relative to 2020 production levels, to satisfy the needs of clean technology deployments. For copper, this growth is equivalent to adding one ~1 MT/y mine globally approximately every two years.

Projections indicate by 2050:

- 56% increase in copper demand

- 102% increase in nickel demand

Projected demand growth for nickel and copper by 2050

Mining companies are facing growing pressure to go beyond their core operations in reducing emissions and managing environmental, social, and governance (ESG) risks in their supply chain. End users driving future demand growth are increasingly focused on broader environmental and social impacts as well as supply security risks such as those highlighted by the recent instability in nickel supply and price. As a result, mining companies will need to manage community, water, and biodiversity impacts along with waste and pollution.

Addressing the mining industry’s emissions challenge

Currently, both nickel and copper production involve emissions-intensive processes. For copper, the emissions intensity is about 4.5 kg of CO2 for every kg of copper produced. Nickel’s emissions intensity is highly variable (~20–80 kg CO2 per kg nickel produced), depending on the purity of the final product and the extraction process used. These emissions intensities are further compounded by declining ore grades as high-grade ore bodies are exhausted and economies of scale enable economic recovery from lower-grade mines. To illustrate this point, for each unit of copper produced in Chile, fuel consumption increased by 130 percent and electricity consumption rose 32 percent from 2001 to 2017, leading to higher emissions and costs.

Increasing recycling rates can avoid some of this. Copper produced from waste produces 65 percent less emissions. Still, the extensive growth in demand will require more primary production.

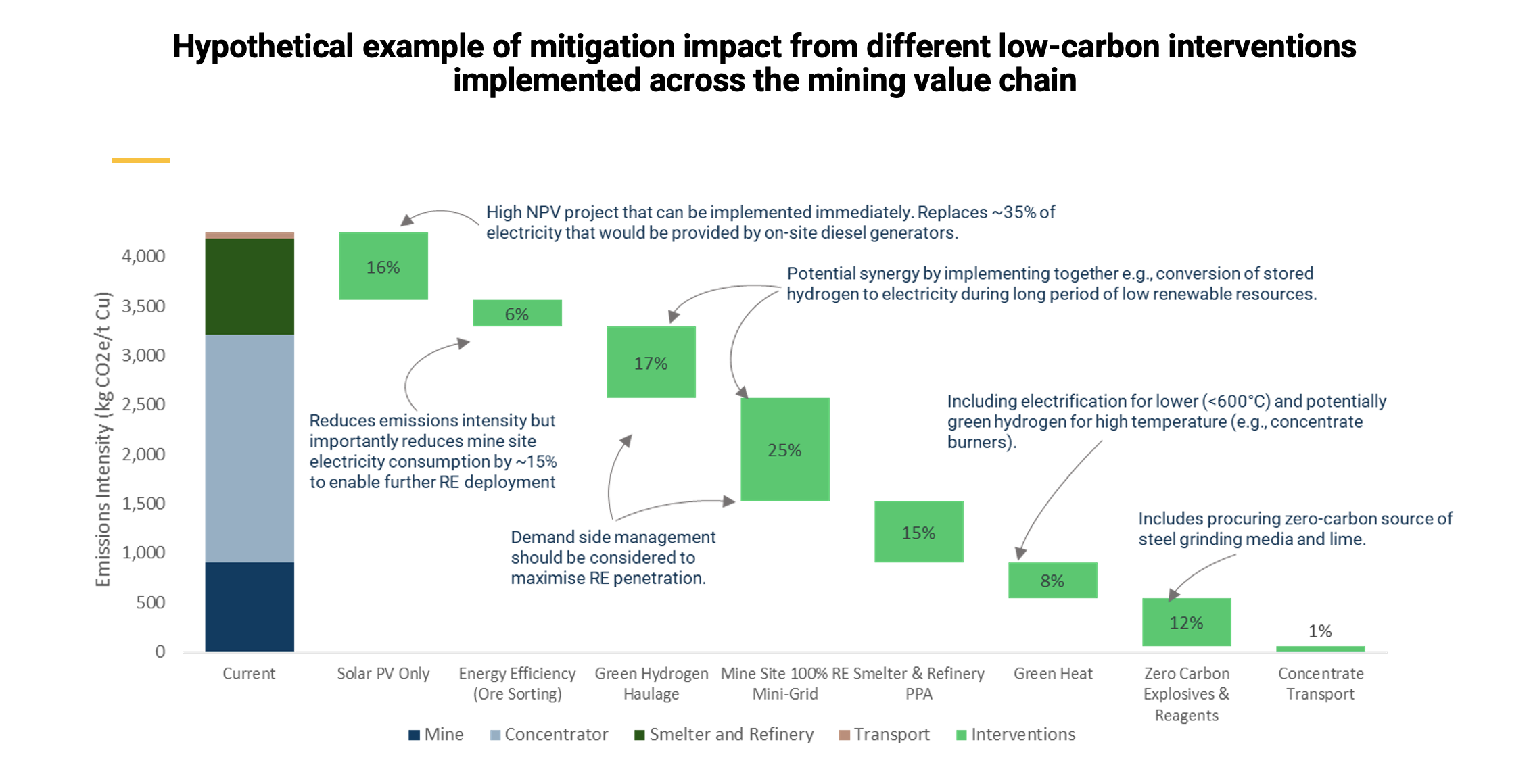

Rapidly declining renewable energy (RE) and storage costs will also enable a sizeable reduction in primary emissions intensity, by way of power purchase agreements (PPAs) for the grid or using direct deployment at the mine sites. However, this will not be enough. Further technology deployments such as electrification of drivetrains and switching to zero-carbon fuels in high temperature processes, will be needed to reach net-zero targets.

Roadmap to net zero

To support the mining industry’s journey towards decarbonization, through the World Bank Group’s Climate Smart Mining (CSM) initiative, IFC has developed a net-zero roadmap for copper and nickel value chains covering scope 1, 2 and 3 emissions of typical mining operations, in partnership with Carbon Trust, Rocky Mountain Institute (RMI), the Colorado School of Mines and the Colombia Center on Sustainable Investment at Colombia University. The roadmap, planned for launch this fall, outlines existing and likely low-carbon technological interventions available over different time horizons as well as ESG and other considerations to inform company decision makers.

The idea is to support companies as they build their decarbonization action plans and encourage continued collaboration among industry players, policymakers, and sustainable finance investors – driving toward a climate-positive future.

Related Content

“A Powerful Path Towards Reconciliation”: How Indigenous Voices Can Be Heard In Mining Governance

Energy Transition

Metals

Mining

Predictions and protection: can software and data improve ESG in mining?

Energy Transition

Metals

Mining