Blog

-

-

Group Head, Intl Government & Sustainability Relations Anglo American

Mar 3, 2023

Newsflash: Sustainability-Linked Finance (SLF) isn’t just about climate. In fact, leading infrastructure companies like Brazil-based energy firm Neoenergia and global mining consortium, Anglo American are embracing the use of key performance indicators (KPIs) that measure their social performance, as part of their SLF frameworks.

These social metrics must meet strict requirements to ensure relevance, benchmarkability, and measurable progress, whether they are tied to sustainability-linked loans or bonds.

For example, Neoenergia’s $115 million “super-green” loan from IFC to enable expansion comes with a target to increase the number of female electricians in its workforce, in addition to emissions-reduction targets.

And, in a first for the mining sector globally, Anglo American’s $100 million sustainability-linked loan from IFC focuses exclusively on social metrics, with an emphasis on delivering benefits for communities in the vicinity of the company’s South African mining operations. But to date, these are outliers in the SLF universe.

Launched in 2017, sustainability-linked finance has become the fastest-growing sustainable finance instrument.

Yet the use of social KPIs in SLF transactions, which incentivize the pursuit of sustainability targets by tying pricing to their achievement, has lagged behind the use of climate-related indicators.

Based on data from Bloomberg, only about 23 percent of the $1.2 trillion SLF issuance to date has included social and governance KPIs, while 68 percent of these transactions come with environmental KPIs, the most common of which have been carbon emissions-related metrics.

It’s easy to see why. There are established scientific methodologies available to measure and monitor the carbon footprint of a company. Measuring meaningful progress on social issues such as gender diversity, public health, social justice, and sustainable livelihoods is more complex, in part because it is newer.

A major challenge here involves the limited amount of data that’s available, possibly because the company doesn’t have a sufficient record of tracking the specific social indicators. Similarly, there is a lack of industry benchmarks for various social indicators. Without such data it’s difficult to measure the ambitiousness of the target.

Other issues include the lack of standard metrics and methodologies on measuring social impact. Even seemingly straightforward KPIs such as local job creation can get bogged down by complicated questions such as: At what point is a job created? How long should it exist before it is counted?

That is not to say that social KPIs cannot or should not be embraced. Clearly, companies like Anglo American and Neoenergia are seeing value in innovating around social metrics. They are using indicators in areas such as diversity and inclusion, access to services, and jobs and community development to strengthen their commitments to local communities, in alignment with their strategy and business operations.

“Society is looking to business to deliver positive impacts. We can only become the preferred developer for host countries through our demonstrated ability to support wider socio-economic development. I’m really glad to see social KPI’s gaining in importance. The data and methodologies to measure impact are becoming increasingly sophisticated and sought after. We are keen to use them to showcase what responsible business can achieve. We know our shareholders, off-takers, local partners, and even employees value this.”

– Anik Michaud, Group Director Corporate Relations and Sustainable Impact, Anglo American.

We suggest that at a time of rising public concern over greenwashing and social washing, integrating credible corporate action on social issues, along with robust environmental commitments, is becoming increasingly critical to unlock impact investment and environmental, social, and governance (ESG)- focused capital.

A new discussion paper from IFC ‘Social KPIs Matter: Setting Meaningful Indicators for Sustainability-Linked Finance,’ explores these issues in further detail, highlighting the challenges and opportunities in the use of social metrics in SLF transactions.

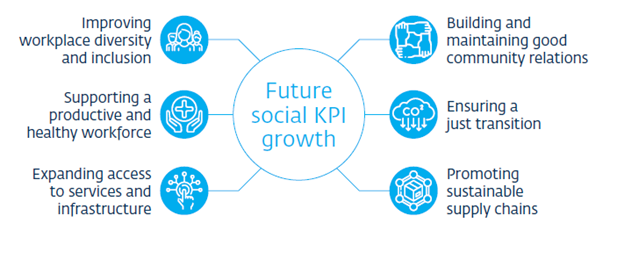

The paper identifies six business imperatives that speak to the value for companies in incorporating social metrics into future SLF facilities:

1: Improving workplace diversity and inclusion

Diversity in all its dimensions is critical to enhancing business and sustainability outcomes. For instance, greater gender diversity is linked with prioritized climate action.

So, social targets that increase the number of women in leadership can enable the achievement of climate targets. Meanwhile, youth represent a significant untapped resource that can help companies stay competitive.

2: Supporting a productive and healthy workforce

For many businesses, ensuring workplace health and safety has always been a priority, but the COVID-19 pandemic has further elevated these issues, while spurring an expanded focus on well-being, and healthy lifestyles.

3: Expanding access to services and infrastructure

Extending affordable public services to the underserved can uplift entire communities, generating impact and productivity in the local economy.

For instance, bridging the digital connectivity gaps that remain in many communities will be key to improvements that reach across all aspects of development, including education, health, gender equality, youth opportunity, and job creation among others.

Business imperatives driving increased adoption of social KPIs in sustainability-linked finance

4: Building and maintaining good community relations

Engaging with the local communities in and around project operations in open and transparent ways can strengthen relationships and increase community satisfaction, reducing the risk of company-community disagreements and potential operational disruptions.

Ensuring that communities share in benefits from commercial developments on their lands is a common material issue across industries. Social KPIs can help capture positive impacts for project-affected communities.

5: Ensuring a just transition

The transition to a low-carbon economy has involved a growing number of net-zero commitments focused on environmental metrics. But the very concept of “just transition” highlights the need to balance the demands of decarbonization with the need to respect the rights and interests of workers and communities.

This is an evolving area that is showing up on more investors’ radars, as the clean energy shift accelerates.

6: Promoting sustainable supply chains

Just as companies look to manage the environmental footprint in their supply chains, they also will need to address social sustainability issues, similar to those within their own operations, such as human rights protections, health and safety, diversity and inclusion, and local community impacts.

IFC provides sustainability coordination and implementation support

As the SLF sector matures and interest grows in incorporating social KPIs, IFC stands ready to assist companies. We provide financing as well as advisory services that support the design and implementation of sustainability action plans to ensure that these instruments achieve their intended objectives.

Read the full “Social KPIs Matter” paper and watch the replay of the launch event on LinkedIn Live. The note provides examples of recent sustainability-linked financing, including several involving IFC in various roles, to highlight how investors can use these new instruments in emerging markets and mitigate greenwashing and social washing risks.

More from IFC on on sustainability-linked financing:

- Social KPIs Matter: Setting Meaningful Indicators for Sustainability-Linked Finance [Draft for Discussion]

- Sustainability-Linked Finance: Expanding Impact in Emerging Markets

- A Sustainable Future for Infrastructure Finance

- 2022 Virtual IFC Sustainability Exchange: Sustainable Finance for Climate and Social Impact

- Brochure | Sustainability-linked Finance

Related Content

How Rwanda’s inaugural Sustainability-Linked Bond broke new ground in leveraging private capital

ESG

Sustainability

Sustainability Linked Financing

Sustainable Finance

How a new financing pact can help climate-vulnerable countries

ESG

Sustainability

Sustainability Linked Financing

Sustainable Finance

Sustainability: A Journey, Not A Destination

ESG

Sustainability

Sustainability Linked Financing

Sustainable Finance